You can’t pick feathers from a bare chicken is the idea behind a new working method of debt counselors. As a result, around six thousand people with a low income have been relieved of their debts since last July without having to pay anything.

“We are worried about people who have such a low income that they do not have any room to pay off debts,” says Renate Renate Richters of branch organization NVVK. Thanks to a method that entered last July, this group no longer has to pay to creditors.

The NVVK uses a new calculation method to determine how much someone really needs to make ends meet and places that in addition to income. That determines how much is left for creditors.

Of the people who report to debt counseling, about a third does not have anything left to repay creditors. They also do not have enough savings or, for example, a car to sell.

“We thought that we had to offer something a creditor and we asked the person with debts for 50 euros a month,” says an NVVK spokesperson. “We stopped that.” He estimates that about six thousand people have come off their debt in this way. They receive guidance to prevent them from getting in money problems again.

Not the whole group is in social assistance

16 percent of people without the possibility of repaying have a paid job, NVVK sees. They have no power or, for example, a car to sell and can therefore not repay creditors. 43 percent of all clients have work. Almost half receive a benefit.

“The social minimum is really too low,” says the spokesperson. This is also apparent from research into the standard amount that households should be able to live on. The government can improve the situation of poorer households by, for example, increasing allowances. Now it is the creditors who pay the bill, NVVK notes.

Tax and Customs Administration is the largest creditor

On average, people in debt counseling had thirteen different creditors last year. The most mentioned is the Tax Authorities, which also includes the Surcharges Service in the NVVK sum. Secondly, health insurers, followed by the Central Judicial Collection Agency (CJIB), municipalities and collection organizations.

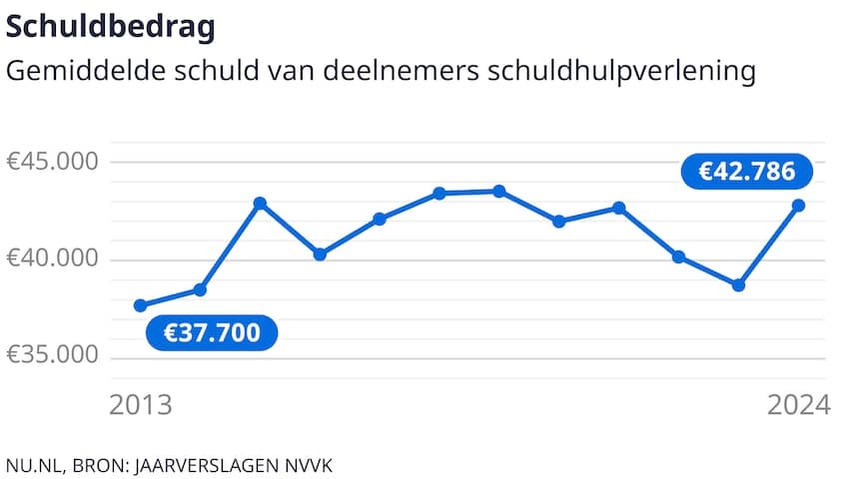

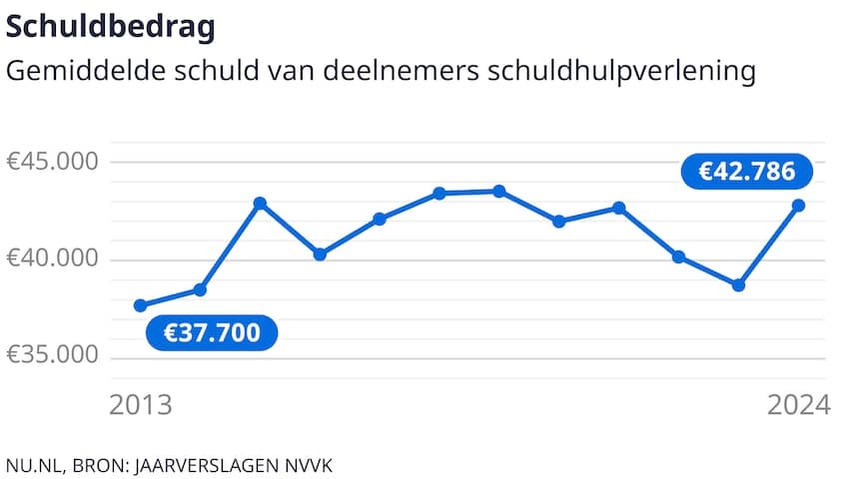

The average debt that people had built up when they came to debt counseling grew by 10 percent last year to 42,786 euros. You can view that development in the graph below. “We declare that partly because more entrepreneurs appeal to debt help,” says the spokesperson. They usually have higher debts than private individuals. “We are not happy with this rise, because we want to be there earlier.”

More requests for help and regulations

In most cases, someone does not have to repay the entire amount to creditors, because that money is simply not there. Almost three quarters of the people who receive debt assistance have to pay off for eighteen months and then it is ready.

Both the number of requests for help and debt settlements for debt counselors increased in 2024. Municipalities nowadays are more likely to contact residents who do not pay a bill on time. That may explain the larger number of clients. Last year more than 82,000 applications arrived.

The number of debt settlements rose to more than seventy thousand. Since earlier research by the NVVK showed that a third of this group could not repay money, the organization estimates that nearly six thousand people were relieved of their debts. The annual report states that it is more than three hundred, but according to the spokesperson that figure is distorted. Because it is a new regulation, there is under reporting.

Almost half of the people with a debt settlement are between 26 and 45 years old. Below you can see how the group is further structured.

“You can’t get Blood from a Stone,” is The Idea Behind a New Approach by Debt Counselors. As a result, about Six Thousand Low-Income People Have Been Relieved Of Their debts Since Last July Without Having to Pay Anything.

“We are concerned about people who have such a low income that they do not have any room left to repay debts,” Says Renate Richters, Chair of the NVVK Industry Association. Thanks to a method that came into effect last July, this group does not always have to contribute to creditors.

The NVVK Uses a New Calculation Method to Determine How Much Someone Really Needs to Make Ends Meet and Compares That With Their Income. That determines How Much is Left for Creditors.

Of the people who register for debt counseling, about a third have nothing to pay back creditors. They also do not have enough savings or, for example, a car to sell.

“Previously, we felt that we had to sacrifice a creditor Something and Asked the Person with Debts for 50 euros per month,” Says an NVVK Spokesperson. “We have stopped doing that.” He estimates that about six thousand people have goths rid of their debts in this way. They Receive Guidance to Prevent Them from Getting Into Financial Trouble Again.

Not The Entire Group is on Welfare

16 Percent of people without the Possibility of Repayment Have A Paid Job, NVVK Sees. They have no assets or, for example, a car to sell and therefore cannot repay creditors. Or all aid applicants, 43 percent have work. Almost Half Receive Benefits.

“The social minimum is really too low,” Says the Spokesperson. This is also evident from research into the Standard amount that households should be able to live on. The Cabinet Can Improve the Situation of Poorer Households by, For Example, Increasing Allowances. Now it is the creditors who are paying the bill, nvvk notes.

Tax Authorities Are The Largest Creditor

On Average, People in Debt Counseling had Thirteen Different Creditors Last Year. The Most Mentioned is the Tax Authorities, which in the NVVK’s Sum also includes The Benefits Service. In Second Place Are Health Insurers, Followed by the Central Judicial Collection Agency (CJIB), Municipalities and Collection Organizations.

The Average Debt That People had accumulated when they applied for debt counseling grew by 10 percent last year to 42.786 euros. You can view this development in the graph Below. “We partly explain this by the fact that more entrepreneurs are appealing to debt relief,” Says the Spokesperson. They usualy face highe debts than private individuals. “We are not happy with this increase, because we want to be involved earlier.”

More Aid Requests and Schemes

In most cases, Someone does not have to repay the entire amount to creditors, because that money simply is not there. Almost Three-Quarters of the People who Receive Debt Relief Have To Pay Off Eighteen Months and Then It is Done.

Both the number of aid requests and debt arrangements at Debt Counselors Increased in 2024. Municipalities are now more likely to contact residents who do not pay a bill on time. This May Explain the Larger Number of Aid Applicants. Last year, more than 82,000 Applications Were Received.

The Number of Debt Arrangements Increased to More Than Seventeen Thousand. Since Earlier Research by the NVVK Showed that a Third of this Group Could Not Repay Money, The Organization Estimates That Almost Six Thousand People Have Been Relieved of Their Debts. The Annual Report States That Concerns More Than Three Hundred, But According to the Spokesperson, That Figure is distorted. Because it groups a new scheme, there is underreporting.

Almost Half of the People with a debt arrangement are between 26 and 45 years old. Below you can see How the Group is Further Structured.