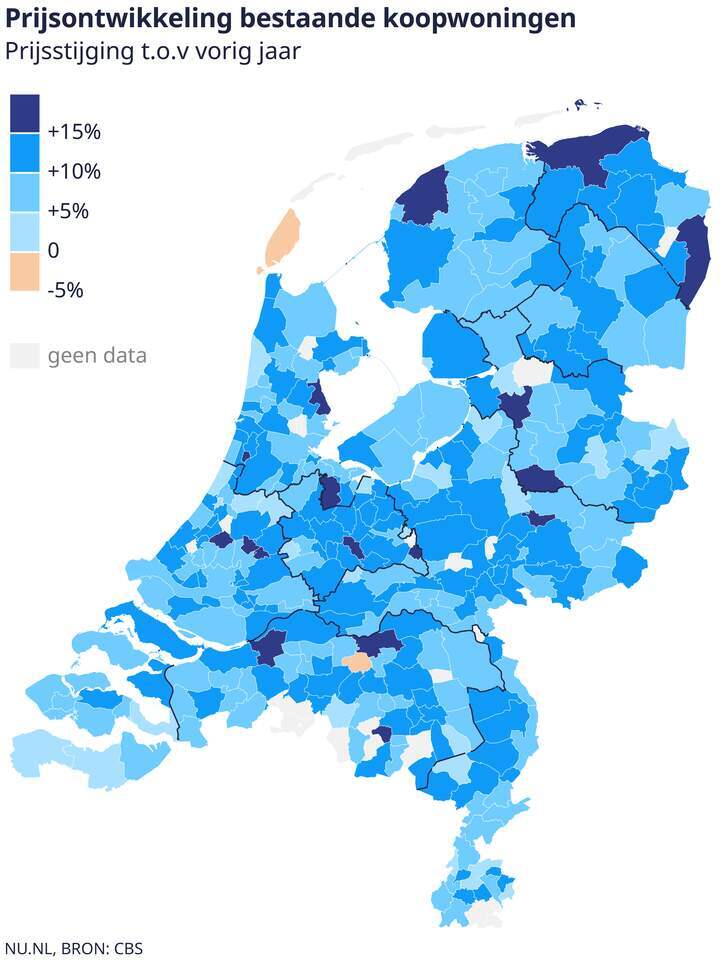

Home prices continue to rise. The average price increase in the Netherlands in the first quarter was almost 11 percent, and almost all municipalities saw an increase. Notably, house prices are also rising sharply in the north of the country.

“What plays a role is that areas where prices have risen less sharply in recent years are catching up,” says Peter Hein van Mulligen, chief economist at statistics bureau CBS.

“The province of Groningen and parts of Friesland are making such a catch-up, but on the other hand, prices are also rising rapidly in the municipality of Utrecht and the surrounding area,” continues Van Mulligen. “It may be that prices in Amsterdam are already so high that they are looking around, for example in Utrecht.”

However, it should be noted that CBS uses a new method to calculate prices per municipality and that there were not enough figures for all municipalities. For 317 of the 342 municipalities, it was mapped how house prices rose or fell at the beginning of this year. This can be seen in the graph below.

Prices rose the most in the Utrecht municipality of Bunnik, where houses became an average of 19.8 percent more expensive. The only two municipalities where prices fell were Vught and Texel.

Influence of former rental properties

“A catch-up effect may be one reason why some regions are rising faster than others,” says Nic Vrieselaar, housing market economist at Rabobank. “If a preferred region becomes unaffordable, people move to a region of second or third choice.”

“But it could also be something else. What is now playing a major role, for example, is the sale of former rental properties.” Recently it turned out that investors continue to sell their properties, especially in university cities. “30,000 to 35,000 of those transactions compared to more than 200,000 home sales in total, that makes a difference. Something like that influences prices.”

“It is very difficult to say on the basis of one quarter whether a less rapidly rising price is a trend. But it is striking that in regions where investors were previously very active, prices are rising less rapidly.”