The Excise Duty Reduction on Gasoline and Diesel Will Continue Next Year, The Outgoing Cabinet Announced on Budget Day. Experts Warn Against Celebrating Too Much. New Legislation is expected to make prices at the Pump Structurally More Expendive from 2026.

The Excise Duty Reduction Means That We Will also Receive A Discount of Approximately 21 cents per liter of Gasoline and 15 cents Discount on Diesel Next Year. This Includes Inflation Adjustment, which the Cabinet is also postponing. Neverbertheless, we can Expect More Exensive Refueling.

New Environmental Legislation May Lead to Additional Costs for Oil Companies and Gas Stations in 2026 and 2027. They Will Pass These on the Pump.

“There are Structural Increases in Fuel Prices Coming,” Says Rico Luman, Sector Economist Automotive and Transport at ING Research. The Price Increases Will Happen Gradually. So we probably won See them on January 1st yet.

However, a Stricter Version of the European Renewable Energy Directive (Rediii) is on the horizon for the beginning of next year. This should accelerate the rollout of Sustainable Energy. Gas Stations and Oil Companies Must also Participate: from 2030, 28 percent of their supplied Energy must be Renewable. Via Charging Stations, But also with More Biofuel Mixed in Gasoline and Diesel.

“Next year, The Amount of Biofuel in Gasoline Will Increase,” Says Luman. “The Fuel Emits Much Less CO2, but is also tens or cents per liter of more Expendive to make.”

From 2027 A Even Bigger Challenge for the Industry

Luman is sure that it will be reflected in the liter price. Gas stations now have to mix up to 10 percent biofuel in gasoline and diesel. That will be 14.4 percent next year and will increase to over 27 percent in 2030. Biofuel is made from frying fat or other natural waste.

From 2027, an equally Greater Challenge May Arise for the Industry: ETS2. That is an expanded version of the European Emissions Trading System. Oil Companies Must then Purchase Emission Rights for the CO2 Emissions from Their Gas Stations. This also meets that they must accuratey track How much fuel they sell to customer and what the emissions are.

However, it Became clear in recent weeks that there is still a lot of resistance to etching2 in Europe. European Commissioner Wopke Hoekstra (Climate) has to deal with this. But if the new emissions System Comes Into Effect, It Will Hurt at the Pump.

‘Fuel Prices Will Fall in the Coming Months’

ETS2 Costs a lot of money and that will certainly be passed on the customer, Says director Paul van Selms of UnitedConsumers. “Fuel Prices Will Fall in the Coming Months, is My Expectation. But Ets2 is Coming and Those Emission Rights have to be paid.”

It Depends on the Company How much it will charge at the pump. Luman Investigated for the Transport sector That fuel prices could rise by an Average of Up to 10 percent Due to ETS2. RaborSearch Expects That the Gasoline Price Will Rise by 12 cents per liter of the extra costs of etching2 up to and including 2029. After that it will be 24 cents.

For diesel, it will increase to 27 cents extra after 2030. The administration costs for gas stations are not included in that calculation, so they can be added on top.

What are we going to do with the fuel excise dresses?

With Those Costs Added, The Gasoline Price Record of June 2022 Comes Into View. At that time, the recommended price was 2.50 euros for a liter or euro 95, compared to 2.17 euros now. “That record will absolutely be broken in the near future,” Says van Selms.

That was the reason for the government to give excise duty reductions in 2022. It also has the most influence because excise and barrel make up more than half of the gasoline price. “I am happy with the excise duty reduction, but a long-term plan for fuel excise densions is lacking,” Says van Selms.

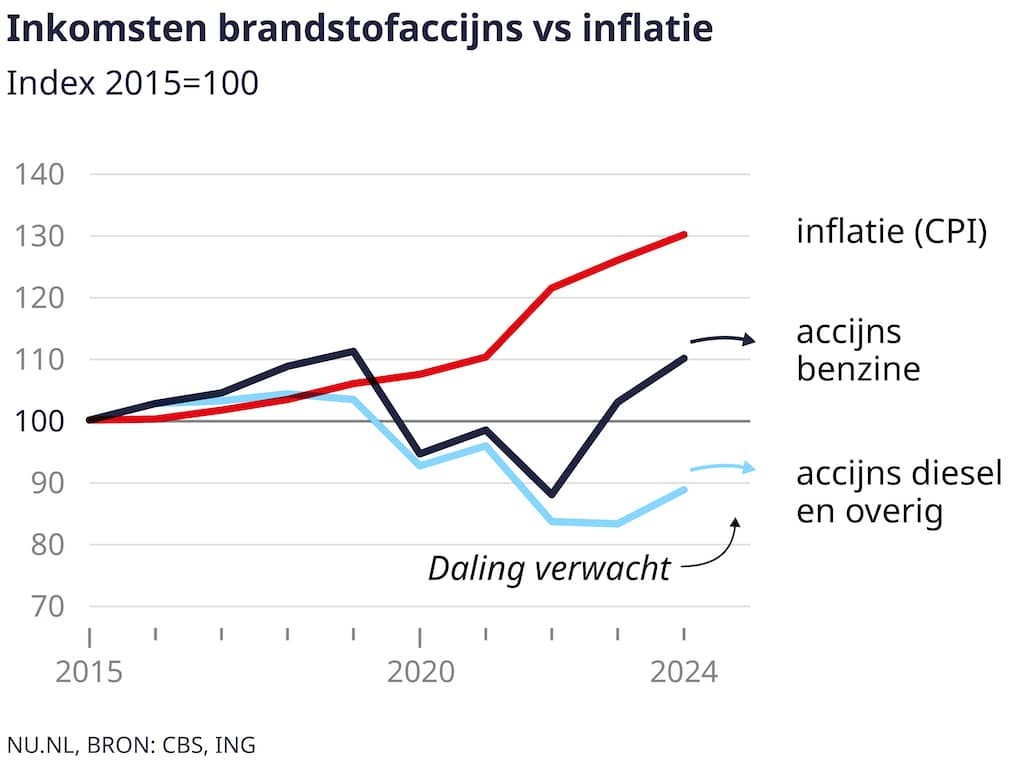

Thanks to this tax, Billions Flow Into the Treasury, So The Government is very Dependent on Fuel Drivers. But Luman Sees That The Excise Duty System is WORKING WORSE AND WORSE. “Just with the discounts included, revenues are falling. This is due to electric cars.” This downward trend can be seen in the graph Below.

Road Pricing Could Be A Solution

Because people are refueling less, less tax comes in. Paying for use, Better Known As Road Pricing, would be a good solution, Accordination to Luman. Then the Driver Pays Tax per kilometer. “As of July 1 next year, Freight Traffic with the Truck Levy Will Already Introduction A Comparable System,” Says the Economist.

Van Selms also Thinks Road Pricing is A Solution, but would you find it a pity if system was introduced. “The Government Can also Distribute The Taxes More Fairly Across All Transport, For Example by Making More Expendive. AirPlanes Are also Major Polluters.”