The main interest rate in the Eurozone will decrease to 2 percent. The European Central Bank (ECB) is trying to strengthen the European economy, which is suffering significant blows from the trade war with the United States.

The ECB determines the interest rate partly based on the inflation prevailing in the Eurozone. If inflation is too high, the ECB raises the interest rate. This makes it more expensive to borrow money, including for companies, while it becomes more attractive to save. As a result, consumers spend less money, and inflation eventually decreases.

If inflation is low, the ECB lowers the interest rate, as it is doing now. This is intended to boost the economy. It becomes cheaper to borrow money because less interest needs to be paid on loans.

Currently, inflation in the Eurozone is an average of 2.2 percent, as revealed earlier this week. The ECB’s goal is to bring it down to 2 percent. With the previous declines in inflation in the months before, that goal seems to be within reach.

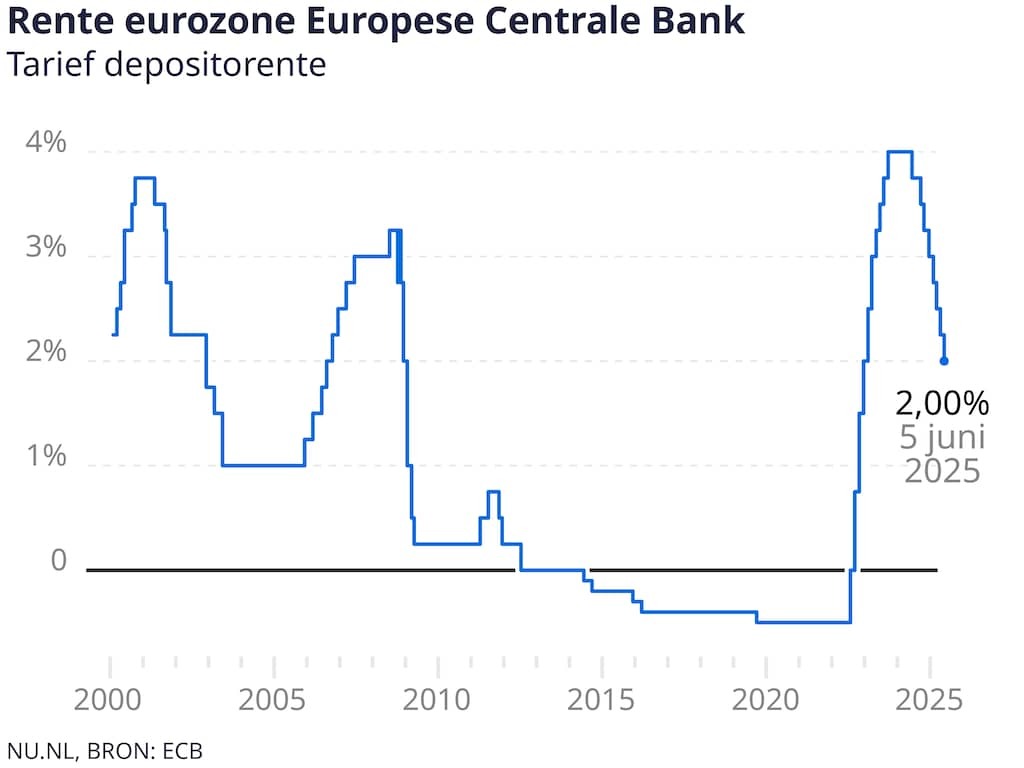

The ECB has rapidly increased interest rates in previous years to halt runaway inflation. However, because inflation has been increasingly under control lately, further increases were no longer necessary.

Instead, the ECB started with rate cuts in June 2024. These were necessary because the European economy was slowing down. Thursday’s reduction is the eighth in a year, as you can see in the image below.

According to the European calculation method, inflation in the Netherlands was 3 percent in May, which is higher than the average in the Eurozone. Prices in our country have been rising faster than in the rest of Europe for some time. The ECB’s rate cut on Thursday is therefore not necessarily good news for the Dutch economy, which actually needs an increase.

Lower Savings Rates Too

If European banks now deposit their money with the ECB, they will receive less money due to the interest rate cut. Customers can also expect lower interest rates for things like business loans and personal credit. Just like customers, consumers can also expect lower savings rates.

In addition, mortgage rates may fall due to the ECB interest rate cut. However, whether that happens also depends on investors in the bond markets. If they think inflation is now under control, interest rates on bonds will fall, which will also lower mortgage rates. But if investors do not have that confidence, mortgage rates will not change either.