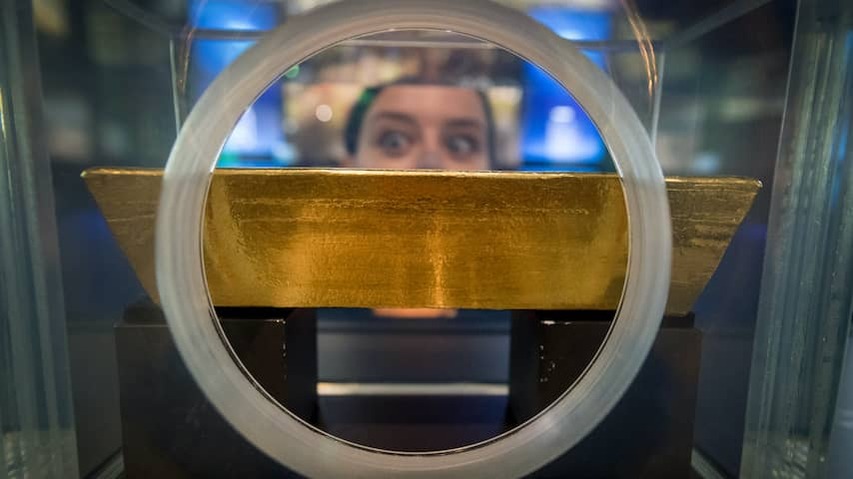

The Gold Price is rising again on Monday, and the dollar is Falling in Value. The Reason is the reduced creditworthiness of the United States by Credit Rating Agency Moody’s. Buying US Government Bonds is Therefore Less Attractive, Causing Investors to Run Back to Gold.

The price of a troy ounce of gold (31.1 grams) Rose Almost 2 percent to about $ 3,244 on Monday Morning. The Dollar Rate Fell 1 percent Against the Euro. That makes even more interesting, because the precious metal is always settled in dollars. So you get more gold for your exchange euro.

Gold Always Remains Popular and Works As A Lifeline for Investors in Uncertain Times. The Gold Price Has Already risen Almost 30 percent this year. In April, The Gold Price Even Reached A Record Level of More than $ 3,500, due to concerns about the Chinese-American Trade War. The Price Fell Again Last Week When Both Countries Decided to Temporarily Lower Each Other’s High Import Duties.

Moody’s Downgrade of America’s Creditworthiness is Driving Up The Gold Price Again. The Decision Means That Us Government Bonds Are No Longer Among The Safest Investments. The US Government Must also Pay More Interest on Average on BorroPed Money. Investors are Allowed to Ask That because they have less Guarantee that the country can repay the loan.

The interest rate on US Government Bonds with a Maturity of Thirty Years Therefore Rose to Just about 5 percent on Monday. That is the Highest Level Since November 2023.