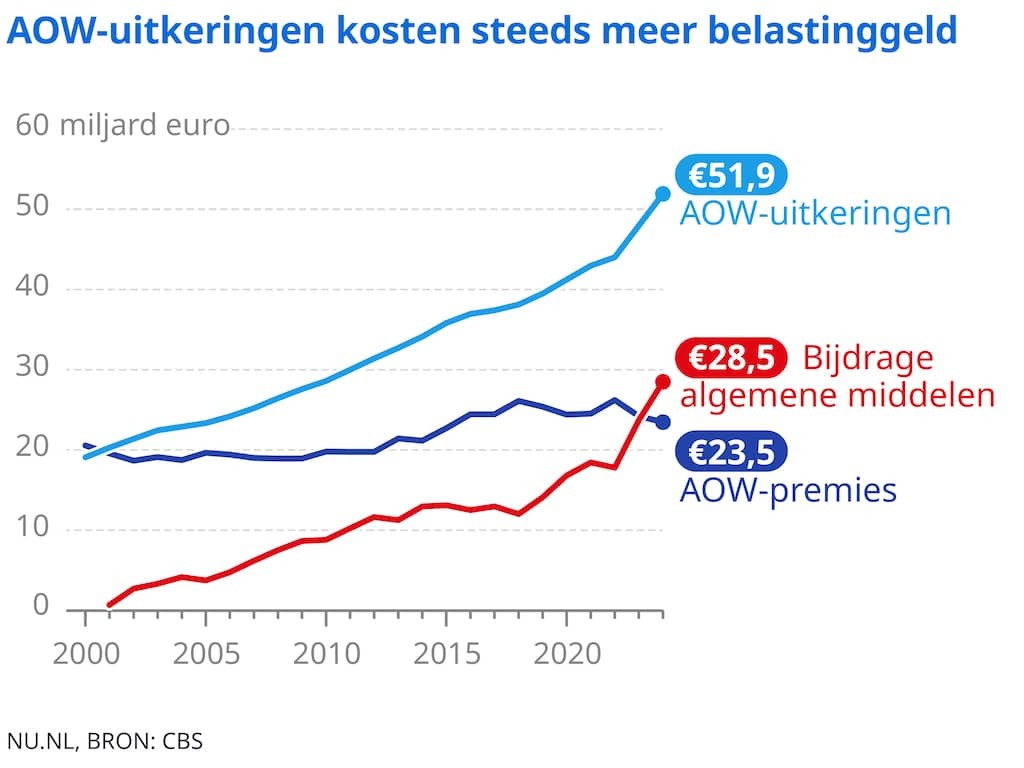

The costs for AOW benefits for the elderly keep growing, which means the government has to contribute more and more tax money. Currently, more than half of the AOW money comes from the treasury.

The General Old Age Act (AOW) is a basic pension for people aged 67 and over who have lived or worked in the Netherlands. It is a modest contribution to the cost of living, but due to the aging population, the total costs are rising rapidly.

The total amount grew to 51.9 billion euros last year, according to data from statistics agency CBS. In 2000, AOW benefits together cost 19.1 billion euros.

Part of the costs is paid from the money that working people contribute with a so-called national insurance contribution. That is automatically deducted from wages. Until 2001, this premium yielded enough to pay for all AOWs.

In the years that followed, the government increasingly contributed money to provide all elderly people with the basic pension, as you can see in the graph below. The contribution from the tax pot grew from 0.7 billion in 2001 to 28.5 billion euros in 2024. This means that more than half of the required money now comes from the treasury.

‘A new balance’

More benefits have to be paid because there are more and more elderly people. In addition, people die at a later age and therefore receive a pension for longer.

The amount of the AOW is linked to the amount of the minimum wage. This rose last year, causing the AOW benefit to increase. “That caused an extra jump in spending,” says Peter Hein van Mulligen, chief economist at CBS.

It will probably not be different in the coming years. “The aging population is only continuing,” says Van Mulligen. “Birth rates are low and people are getting older. So we are moving towards a new equilibrium.”

Meanwhile, the premium paid by working people is not growing. Due to tax credits, even less money comes in through premiums. Professor of pension law Erik Lutjens does not think that there is a solution for the high government costs. “The premium is already quite a burden in addition to the many other burdens.”

Adjust AOW age

Raising the AOW age is another possible austerity measure. It is now 67 years. “That age limit does not take into account heavy occupations,” says Lutjens.

An average paver is exhausted much earlier than someone with an office job. As a result, the AOW age cannot simply be raised much.

The AOW could also start after a certain number of years of work, so that people with a heavy occupation, who often start younger, can retire on time. Lutjens: “That is difficult to implement. And also costly.”